The People Have Spoken!

(Well, Some People Have Spoken)

By Steven Leigh Morris

Absent data to help explain local theaters’ current malaise — assuming the number of productions plummeting region wide is a malaise — Stage Raw first went to the most likely experts in the area, in L.A. County’s Department of Arts and Culture.

Statisticians there said they don’t have data to answer our burning questions about attendance patterns, or the theater’s budget differentials between 2018 (before all theaters endured the Covid shut-downs) and 2023. The best way to answer our questions, they said, is to do our own surveys. So we did: One for patrons and one for theaters. While this involved some pleading and cajoling, over 150 patrons did respond, along with 21 local theaters (large and small) who weighed in on our second survey.

So much data have poured in that we’re breaking down the results and their analysis into segments, starting with the patron responses, which alone will take three of four of these articles.

This article will deal primarily with age and aging. Next week, we’ll examine ethnicity, attendance habits and patrons’ reactions to the content our local theaters are serving up. After discussing patron reactions, we’ll dig inside each age, gender, and ethnic group and see where attitudes converge and/or spin away from each other. Then we’ll follow up with what the theaters are reporting, and how that may conform to or digress from the patron perspectives.

Stage Raw wishes to express its gratitude to Bronwyn Mauldin, Director of Research and Evaluation at the Los Angeles County Department of Arts and Culture, for her comments on an earlier version of this article.

What We Know and What We Don’t

Our 152 patron sample isn’t “generalizable,” meaning we can’t make grandiose and specific pronouncements, but it can offer a general guide to possible trends. Some of the results contradict common assumptions, which is always fun. Some don’t. So let’s start with generalities.

Gender

As is clear from the pie-chart above, 49.3% of respondents identified as female; 46.1% as male; and 4.6% weighed in as non-binary. To be honest, this isn’t a particularly controversial or even interesting result.

As is clear from the pie-chart above, 49.3% of respondents identified as female; 46.1% as male; and 4.6% weighed in as non-binary. To be honest, this isn’t a particularly controversial or even interesting result.

Journalists With Access to Press Passes

This was really a marketing question, designed to raise the issue of how many respondents were entitled to press passes versus those audiences who presumably paid for tickets. One might infer from the results that nine out of ten respondents paid for their theater tickets — unless they were friends of actors/designers/producers and given comps, depending on the comp policies of the theaters — a detail we didn’t record.

This was really a marketing question, designed to raise the issue of how many respondents were entitled to press passes versus those audiences who presumably paid for tickets. One might infer from the results that nine out of ten respondents paid for their theater tickets — unless they were friends of actors/designers/producers and given comps, depending on the comp policies of the theaters — a detail we didn’t record.

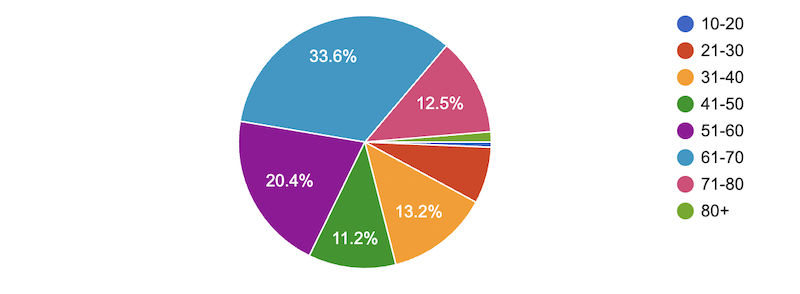

Age

If our results are representative, our theater audiences are an older crowd, but perhaps not as old as many have feared, with almost one third (32.3%) of respondents identifying as 50-years-old or younger. The remaining two thirds (67.7%) identify as age 51 and older.

Still, the statistic that might set off alarm bells is that almost half (47.4%) of our audiences (who reported in) are over 60 years old.

The largest single segment (33.6%) is a group aged 61-70 years old. It’s chastening to see how that one 10-year group of respondents represents a higher percentage of our theater audiences than all audiences who identified themselves as under 51 (32.3%). People over 80 represented 1.2% of all respondents. People 11-20 years old represented 0.7% of all respondents. (There’s a rub.)

But digging a little deeper might challenge common presumptions that saturate our youth-obsessed culture.

On September 6 the New York Times published a marketing article by columnist Farhad Manjoo that largely echoes a 2021 article in Media Voices.

The point of both articles is that, from a marketing perspective, Facebook’s Mark Zuckerberg is out of his mind by obsessing on how his social media platform should cater to young audiences, as it did in when he launched it in 2004. Largely mirroring the theater audiences who responded to the Stage Raw survey, the vast majority of Facebook users are now 50 or older. Even so, Zuckerberg has been doing contortions to woo younger audiences with strategies that actually denigrate his older readers. His ageism is completely at odds with his financial interests, both columnists write.

Writes Media Voices, “By shifting attention away from the primary users of the platform, Zuckerberg is risking a huge revenue opportunity. The buying power of people over 50 has never been stronger. Known as the ‘silver spenders’, this age group are the wealthiest age cohort in the world, and are projected to spend $15 trillion by 2030.”

Adds Majoo in the New York Times two years later, “’The tech industry’s hostility to aging continues to violate common sense,’” says Joseph Coughlin, the director of M.I.T.’s AgeLab. . . His lab conducts research on how an aging population is changing business. [It has discovered] that companies in the auto industry, financial services, retail and other sectors are coming around to the emerging opportunities of the “longevity economy,” the 1.6 billion people around the world who will be 65 or older by the year 2050.”

Will live theaters take comfort from these marketing opportunities in the tech industry? What neither article addresses is whether or not the younger social media users who will age in the coming decades will transition from TikTok and IG and X to Facebook and Meta. Similarly, will theaters be able to bring currently younger generations into its fold as those potential audiences age?

There’s a long-established answer to that, and it’s underscored in Stage Raw’s survey results. Young people who attend theater as children may well drop away during their working lives, but the odds are good that they’ll eventually return in their later years when they have the discretionary time — if and only if they were exposed to theater as children.

Here’s our support for that notion, in two related questions:

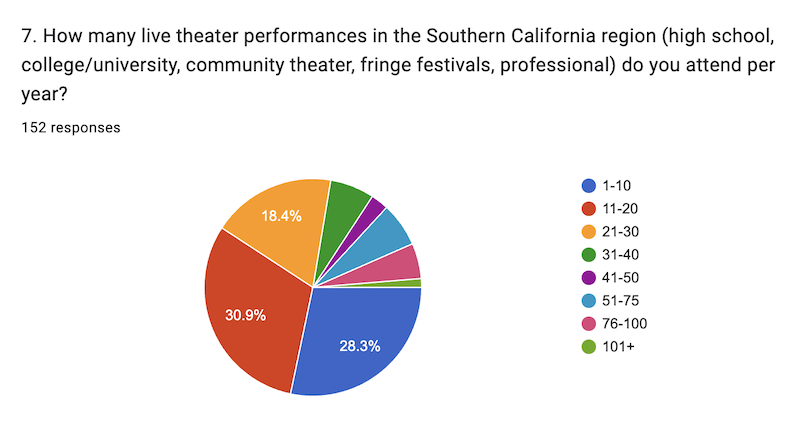

Productions Attended Per Year

First, it’s important to know to what extent our respondents (which we’ve already identified as largely over 50) are attending theater on pretty much any SoCal stage.

Per annum, almost 60% reported seeing from 1–20 performances (the lion’s share of responses). 25% saw 21-40 shows; 9.2% saw 41-75 shows; 5.3% saw up to 100 shows, and 2.3% saw over 100 shows per year = about 2 shows per week, year in year out. It’s probably not surprising that the upper categories were filled by our 10% of journalists.

Now, given these general attendance trends, here comes the big reveal:

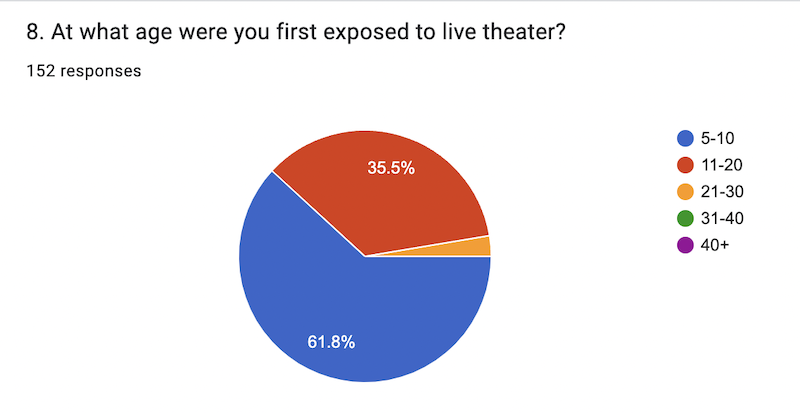

First Exposure to Live Theater

A whopping 97.3% were first exposed to live theaters between the ages of 5 and 20, with 61.8% of our respondents reporting that they were first exposed to live theater before they were 11 years old.

If this doesn’t speak to the urgency of youth arts programs, in our schools and in our theaters, I don’t know what does.

Next week, we’ll discuss ethnicity, attendance habits, and the varying levels of patrons’ enthusiasm for what our local theaters are presenting.